Pine Labs, a startup that offers merchants payments terminals, invoicing tools and working capital, said on Monday it has completed the first close of a $285 million funding as the nearly two-decade-old firm looks to expand its business.

Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures and Ward Ferry Management financed the new funding round, while existing investors Temasek, Lone Pine Capital and Sunley House Capital also participated in it, the Indian startup said.

The new round valued Pine Labs at $3 billion, up from about $2 billion in a December round last year and $1 billion in early 2020. Pine Labs operates in several Southeast Asian markets as well.

“We’re thrilled to welcome marquee investors like Marshall Wace, Baron Capital Group, Ward Ferry Management, Duro Capital and Moore Strategic Ventures to the already pristine cap table of Pine Labs. This is an exciting phase in our journey as we enter newer markets. We excel in enterprise merchant payments and now want to scale new frontiers in the online space as well, at the same time continue to power the credit and commerce needs of our offline merchant partners,” said B. Amrish Rau, CEO of Pine Labs, in a statement.

The startup, which also counts PayPal among its investors, serves over 140,000 merchants. Its payments terminal — also known as point-of-sale machines — are connected to the cloud, and offer a range of additional services such as working capital — to the merchants.

Pine Labs runs an analytics app on debit card base of banks it tied up to determine the extent of credit to be made available to every cardholder. PineLabs then converts large payments into EMIs (equated monthly instalment) using its Pine Pay Later application. Amid the pandemic late last year, the startup was onboarding over 10,000 new businesses to the platform each month.

Pine Labs is the market leader in many categories. The startup — which acquired Qwikcilver in 2019 — assumed over 95% of the market share in gift cards in the financial year that ended in March 2020. Its point-of-sale machines are some of the most widely used in the industry.

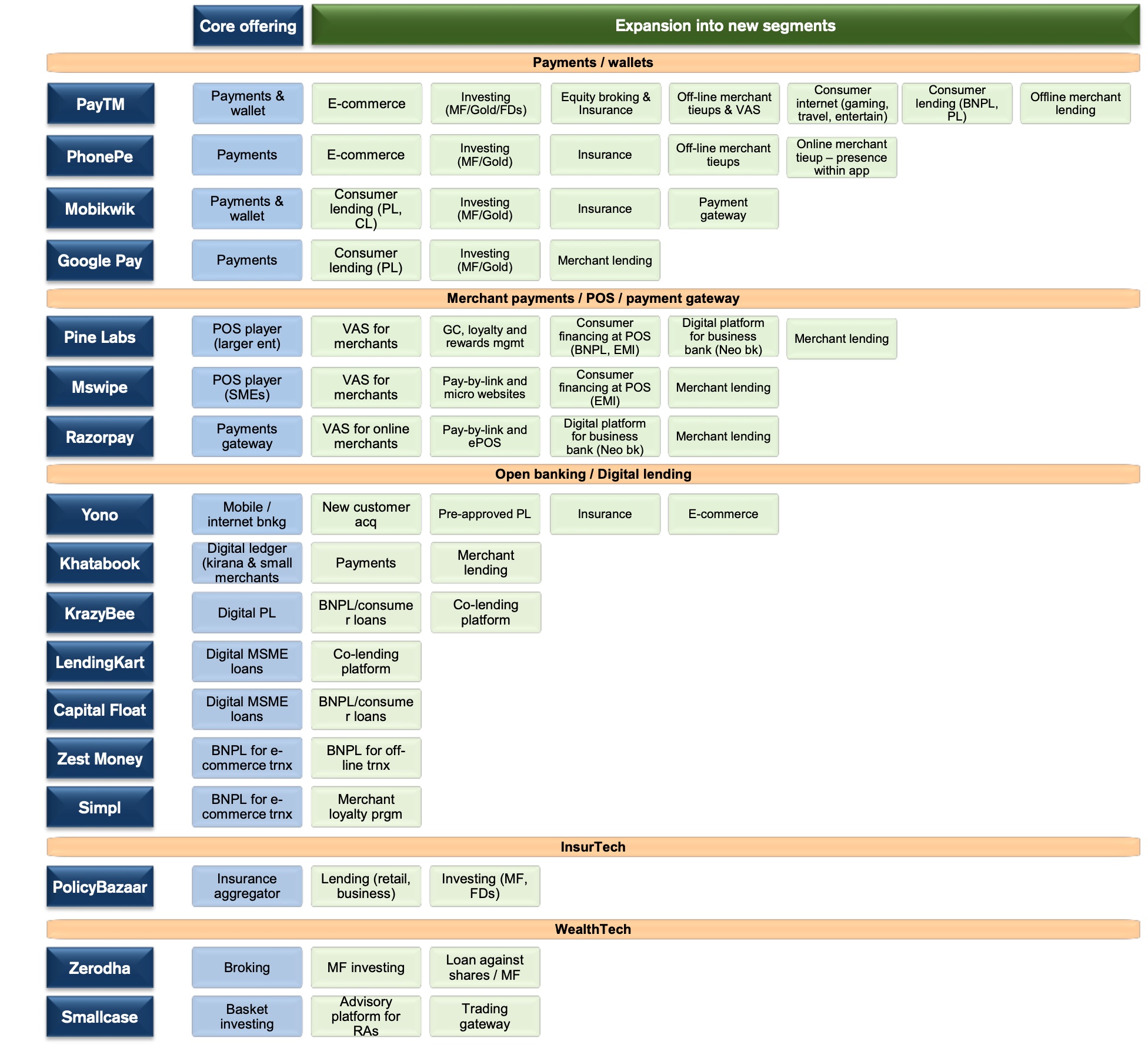

FinTechs expanding into newer segments to increase engagement, the addressable market and drive monetisation (Image: Credit Suisse; Data: Company, Credit Suisse)

“We are very excited to be a part of the technological transformation that Pine Labs is driving on the ground in payments and the multiple interlinkages and efficiencies it is able to create by providing faster, cost effective consumer access to a broader range of financial products such as BNPL (Buy Now Pay Later), where it is driving a pioneering effort on behalf of the financial system. We are also excited about an Indian business being able to drive regional and potentially global adoption of its Intellectual Property and this represents significant optionality for the future,” said Amit Rajpal, CEO and Portfolio Manager of Marshall Wace Asia, in a statement.

More to follow later today.

Merchant commerce platform Pine Labs valued at $3 billion in new fundraise posted first on http://bestpricesmartphones.blogspot.com

No comments:

Post a Comment