What a busy week in the world of media liquidity.

That’s a sentence you don’t get to write often. Regardless, news broke this week that Axel Springer is buying U.S. political journalism outfit POLITICO. The transaction was expected, but the eye-popping roughly $1 billion price tag still has tongues wagging. We even got on the podcast to chat about it.

And Forbes announced that it is going public via a SPAC. The business publication’s news follows BuzzFeed’s journey to the public markets through a blank-check company. Hot media liquidity summer? Something like that.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

That TechCrunch is in the process of being sold to private equity, of course, is not something that we should forget. Shoutout to the Verizon bankers who found a way to get rid of us while also deleveraging Verizon’s debt profile. Ten points.

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

What’s it worth?

In corporate-speak, Forbes Global Media Holdings is merging with blank-check company Magnum Opus Acquisition Limited. The transaction will close either Q4 2021 or Q1 2022, Forbes estimates.

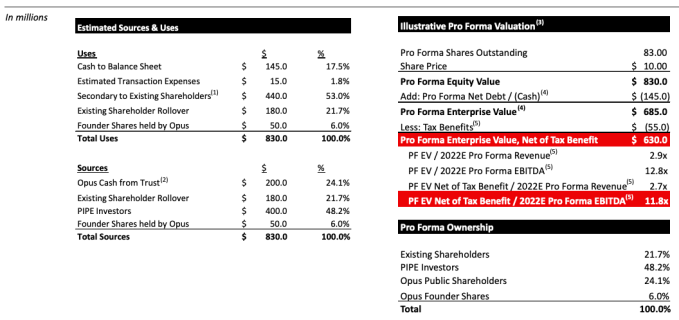

The deal itself is somewhat modest in scale compared with other SPAC deals we’ve recently looked into. Forbes reports that it will sport “an implied pro forma enterprise value of $630 million, net of tax benefits,” after its completion. Some $600 million in gross proceeds will be derived from Magnum Opus funds “and $400 million of additional capital through a private placement of ordinary shares of the combined company,” Forbes writes.

The company will sport an equity valuation of $830 million after the deal closes, per its own calculations. That number will change some depending on redemptions ahead of the combination. The gap between the large dollars going into the deal and the modest final valuation of the public Forbes entity is due to some $440 million in secondary transactions for existing Forbes shareholders.

In case you’d prefer all of that in table form, here’s the Forbes investor deck:

Image Credits: Forbes SPAC deck

Is $830 million a fair price? Let’s dig into Forbes’ results.

Forbes jumps into hot media liquidity summer with a SPAC combo posted first on http://bestpricesmartphones.blogspot.com

No comments:

Post a Comment